Apps can help us drink more water, track our food and exercise, entertain us during our commute, and find us the cheapest place to buy fuel. There are also a slew of finance apps you can use to help you with your personal budget, business budget, and expense tracking. Today we are bringing you the top apps to use to hit your savings goal.

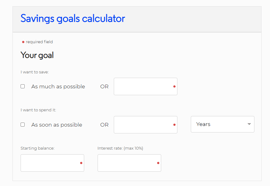

Moneysmart.gov.au's 'Saving Goals Calculator', lets you input your savings goals, then calculate how long it will take to achieve them. The app has features that help you to visualise your saving progression and hit those goals. There are a number of other caluculators on the site that will help you with your financial goals also.

Level Money will automatically collate all your bills and recurring expenses after connecting it to your bank account, and will then give you a suggestion as to how much you should be saving each fortnight. Level Money has a feature which allows you to set up an auto-save amount, and encourages you to roll any leftover cash into your savings as well. This app gives you the tools to build a habit of saving money every single month or fortnight, and will also help those new to saving by automating the process.

Clarity Money works autonomously to separate wise spending from unwise spending. The app will work to cancel any subscriptions you don’t use anymore, and can even locate ways to cut down the cost of your bills by changing providers or locating discounts. It also provides you a place to track all the money you have saved from unnecessary expenses and put it into a savings account.

Beyond Debt is a trading name of DCS Group Aust Pty Ltd. Australian Credit License: 382607. RDAA Number: 1126. PO Box 3074 Newstead, QLD, 4006.

DCS Group operates under a Limited Liability scheme approved under Professional Standards Legislation